الدائرة الخاصة لإستثمارات الأسر

الدائرة الخاصة لإستثمارات الأسر

Some families need a wider range of services than what typical wealth managers provide. Their financial planning may require a multigenerational perspective that encompasses advanced estate planning, philanthropy, business planning, lifestyle services, and family development.

By taking on the role of family CFO, we can build a unique model around our clients’ families unique needs. We can coordinate their investment management, advanced planning strategies, and comprehensive administrative support to solve complex problems, ensure meticulous implementation, and free up our clients’ time to live their ideal lives.

Our Family Office Vision

Privately held professional entity established to manage the investments, business affairs and philanthropic interests of a high net worth family.

- Implement a strategy

- Effectively diversify, manage and enhance wealth

- Strike a balance between business and family interests

- Assist with family communication through a charter help to unite a family

- Transfer wealth

- Co-ordinate management activity

- Increase financial leverage

- Mitigate against conflicts of interest and

- Enjoy a chosen life style

Our Family Office Services

At the heart of any family office is investment management and financial oversight, but as your family office we can provide a number of different services

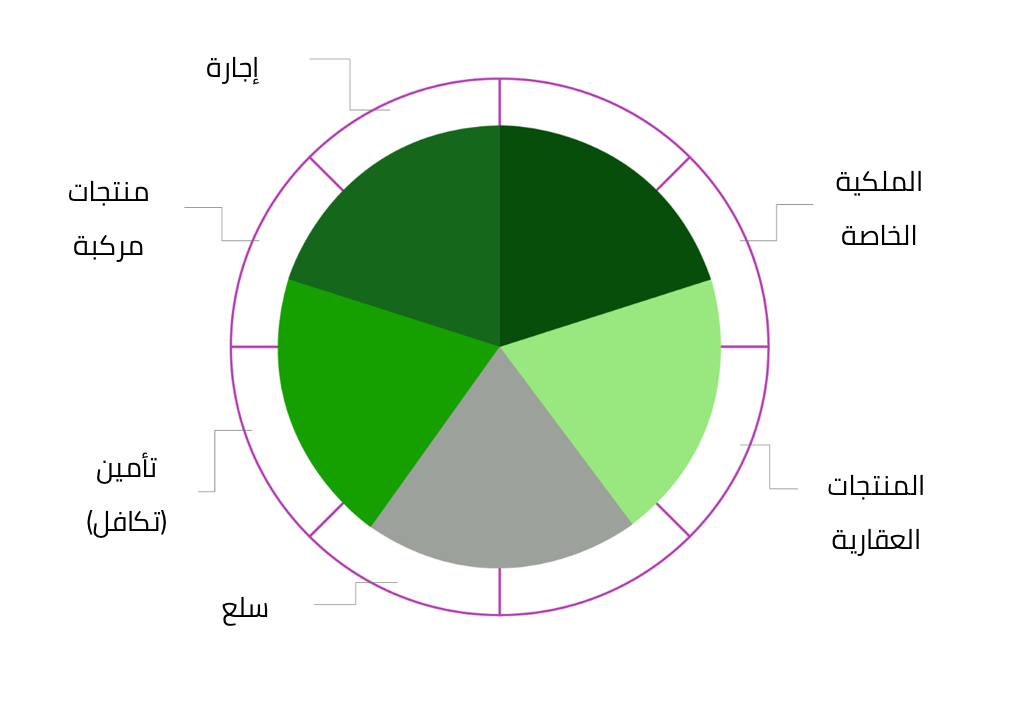

Investment Management Services

Typically, this will be the main reason for setting up a family office, as it is central to ensuring wealth preservation. These services will include:

- Evaluation of the overall financial situation

- Budget services, including wealth reviews, analysis of short- and medium-term liquidity requirements and long-term objectives

- Determining the investment objectives and philosophy of the family

- Determining risk profiles and investment horizons

- Recommendation and monitoring of a suitable asset allocation plan

- Recommendation of suitable investments

- Providing due diligence on investments and external managers

- Discretionary asset management

Philanthropic Management / Islamic WAQF

An increasingly important part of the role of a family office is managing its philanthropic efforts. This will include the establishment and management of a foundation, and advice on donating to charitable causes. These services would typically involve:

- Philanthropic planning

- Guidance in planning a donation strategy

- Assistance in formation of foundations and charitable trusts

- Organizing charitable activities and related due diligence

Business and Financial advisory

Beyond the asset management advisory as your family office we will also assist in providing advisory services on financing and business promotion. These will include:

- Debt review and management

- Bridge financing

- Structured financing

- Private equity

- Mergers and acquisitions

- Succession planning

Estate and Wealth transfer

As your family office, we will be involved in business succession and legacy planning along with your legal team, enabling the transfer of wealth to the next generation. These services will include:

- Wealth protection solutions and planning related to of all types of assets and income sources

- Asset protection strategies

- Guidance on family governance

- Guidance regarding wealth transfer to succeeding generations

- Assistance with the adoption of a family charter or constitution

How can we serve you?

Do you have ideas? Share your opinions and suggestions We will be happy to do so!