Asset and Wealth Management

Al Nefaie International Money Managers Platform

The Top 1% of Global Money Managers. In One Place.

Al Nefaie Opens architecture. Endless opportunities.

Generally, we believe the outcomes being delivered to investors are not acceptable. A short term focus results in a lack of awareness of investment cycles and poor decision-making.

There are some fantastic investment funds and managers out there covering the entire risk return spectrum. However, many of the very best remain undiscovered by most investors, or have high minimum application amounts which limit the ability of many to invest with them.

At Al Nefaie, we believe in identifying those managers and combining them in a diversified portfolio that has the potential to lead to a much better investment outcome over the long term.

How We Find The Best?

We employ an Open-Architecture investment Management Platform that enable us employ suitable Sharia compliant investments from reputable global sources to achieve the client’s objective needs.

Al Nefaie continuously screens potential investment opportunities to unearth the best investment funds and managers available in the global markets and across asset classes. We make sure that every fund manager we invest with will provide the highest return with lower than average volatility over the long term. In a multi-phase process based on qualitative and quantitative analysis, we select the best investment funds available and monitors them closely.

Our Partners [Third Party]

Al Nefaie Funds

Al Nefaie, the trusted Sharia Compliant partner for the long term, Clients holding a portfolio of investments need a solid, reliable and trusted asset manager who can grow and protect their wealth – with a relentless focus on their interests and those of future generations. At Al Nefaie, our expertise in fund management – combined with the most advanced asset management techniques – means that our clients can be confident that their assets are in the hands of trusted professionals – allowing them to dedicate more time to the things that matter most to them.

Saudi Equity Comprehensive Fund

Fund’s NAV Chart

Fund’s Information

Fund’s Documents

- شروط و أحكام الصندوق

- Fund’s Fact Sheet

- Fund’s Financial Statement

- Fund’s Annual and Short-form Annual Reports

- Fund’s Interim Reports

- تعلن مجموعة النفيعي للاستثمار عن التقرير الاولي للاداء 2019 لصندوق النفيعي للطروحات الاولية

- تعلن مجموعة النفيعي للاستثمار عن التقرير الربع سنوي لصندوق النفيعي للطروحات الأولية للربع الثالث لعام 2019م

صندوق مزايا للمرابحات

Fund’s NAV Chart

Fund’s Information

Fund’s Documents

- شروط وأحكام الصندوق

- Fund’s Fact Sheet

- Fund’s Financial Statement

- Fund’s Annual and Short-form Annual Reports

- Fund’s Interim Reports

- تعلن مجموعة النفيعي للاستثمار عن التقرير الربع سنوي لصندوق مزايا للمرابحات للربع الثالث لعام 2019م

Asset Allocation & Bespoke Discretionary Investment Mandates

For each client, we initially develop a target asset allocation that it is tailored to the client’s specific financial situation. We then implement an investment program consistent with that target allocation, selecting securities that, in our fiduciary capacity, we deem to be in the client’s best interests.

Al Nefaie brings special expertise in the areas of financial assets (Sukuk and public equities) as well as alternative investments, particularly real estate and private equity. Where suitable, we research special opportunities in these sectors.

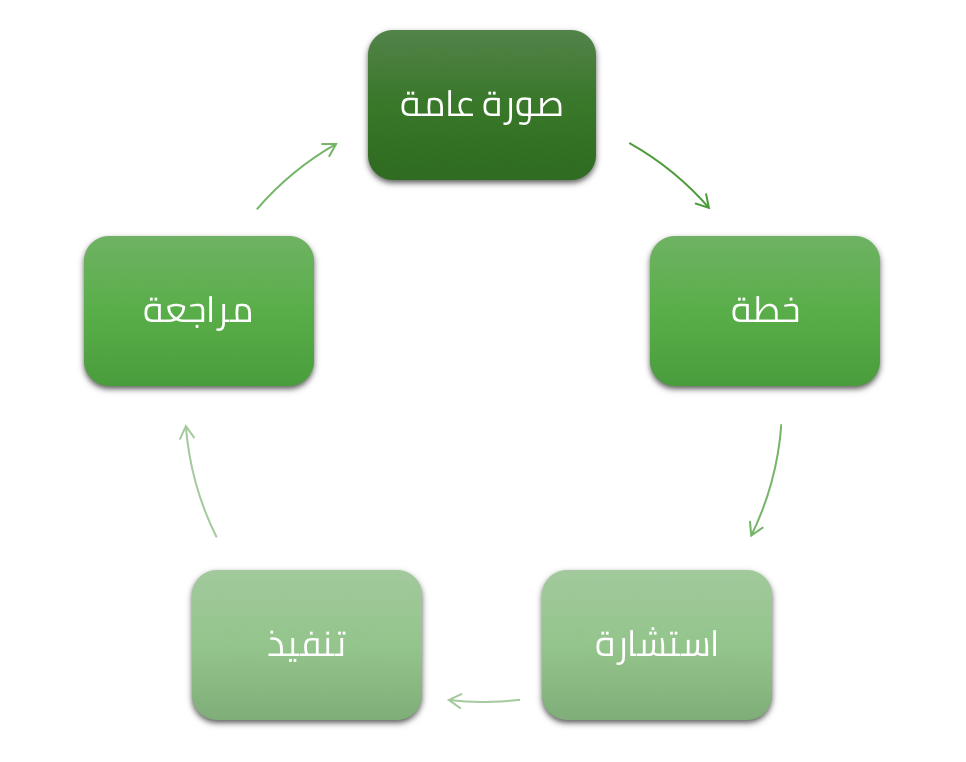

Our Investment Process

Our Investment Approach

- Total return approach considers client’s unique needs, risk appetite, investment time horizon and liquidity requirements.

- Total portfolio risk management on capital preservation.

- Structured and consistent investment approach with ongoing consultation with client.

- Segregated account with transparent reporting.

- Regular and ad-hoc portfolio review.

- Direct access to portfolio specialist.

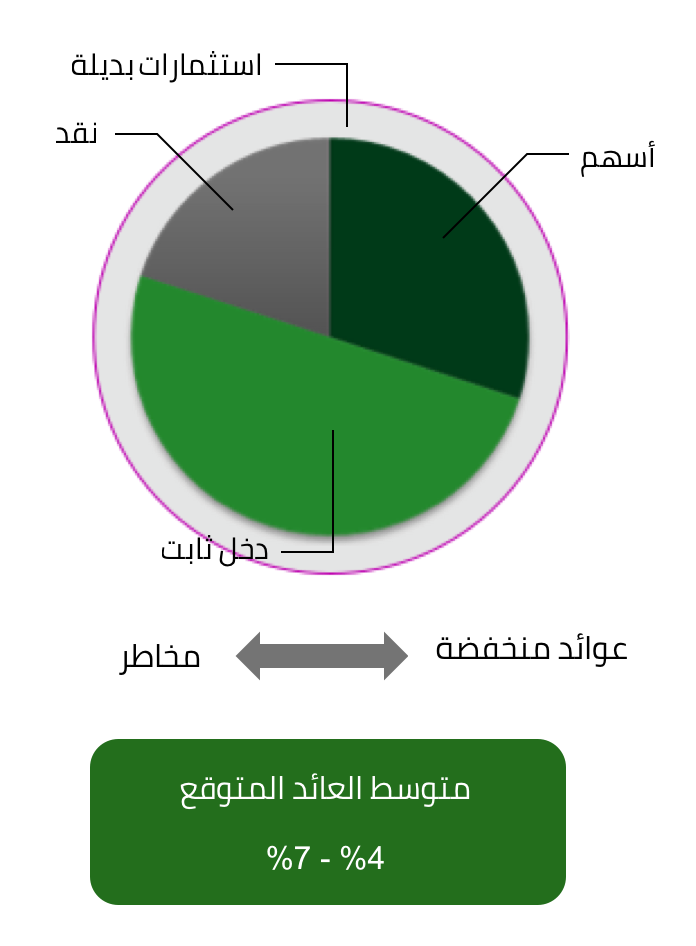

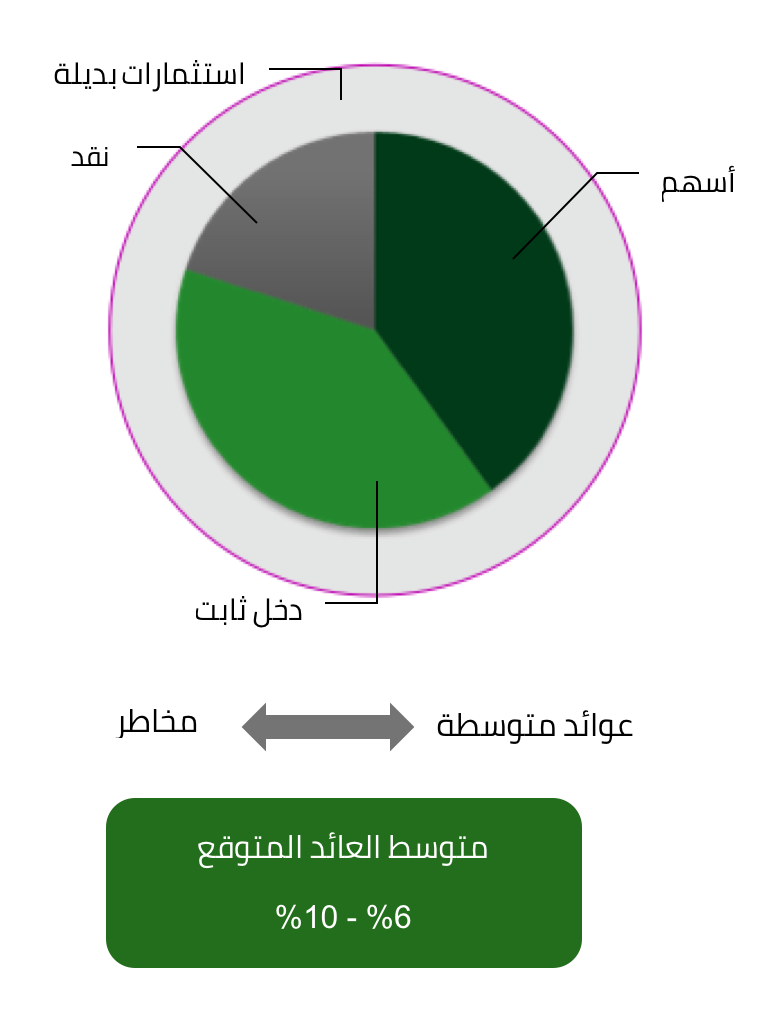

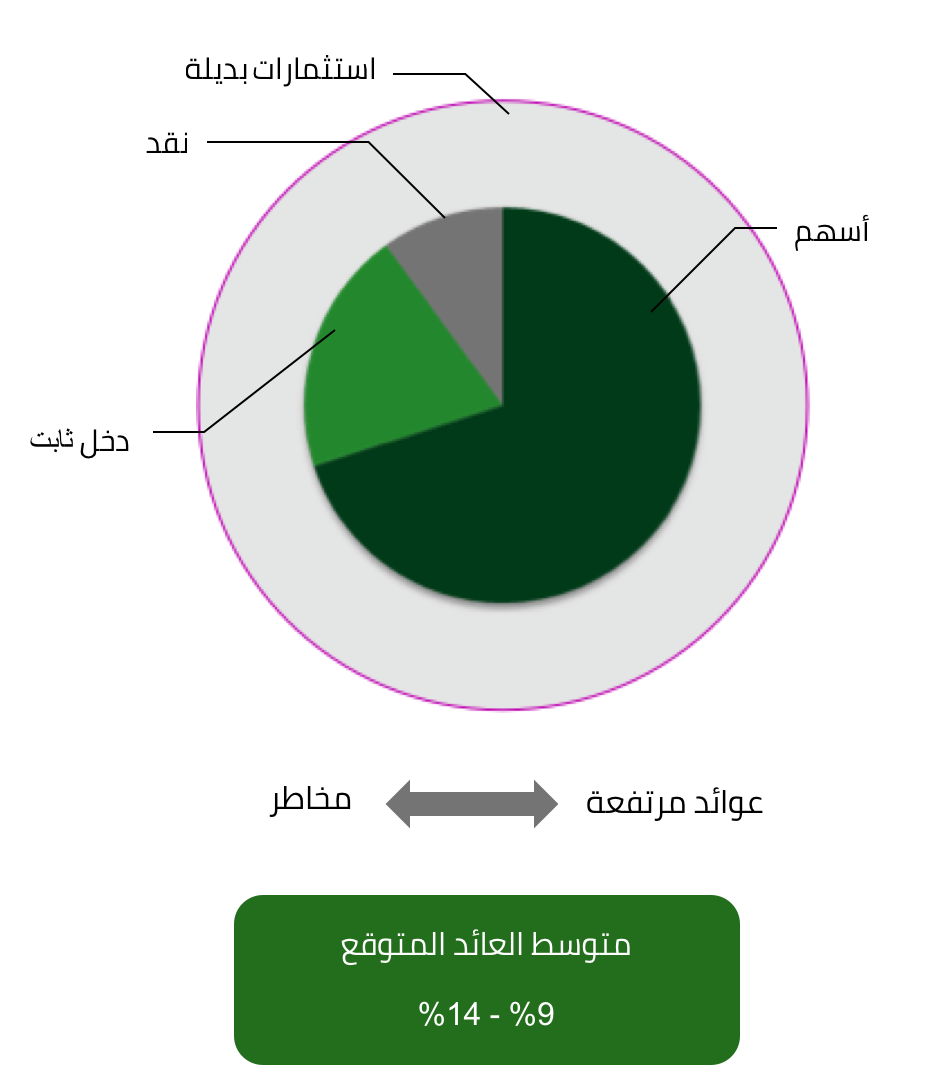

Portfolio Selection / Investors’ Profiling

Conservative

Balanced

Growth

Example of a Growth Portfolio

The customer portfolio should contain asset types that provide a range of risk-return characteristics.

To categorize the asset types in a simpler way, Al Nefaie offers two types of holdings for its customers:

Core holdings

- Asset classes include equity, fixed income and cash

- Comparatively more liquid and lower risk investments

- Delivered through best in class regional direct equities, Sukuks and Sharia compliant funds

Alternative holdings

- More sophisticated investment products that have a higher risk/return profile and are lower on liquidity

- Include PE funds, Structured Products, RE funds etc

Wealth Management

Our wealth management approach helps organize and bring clarity to our clients’ financial lives. It begins by identifying their unique financial goals and developing a practical plans to meet them. We believe the value of advice is in execution, so we are here to implement every aspect of our clients’ plans through leveraging our investment expertise, institutional partners, and comprehensive resources. Then, we provide ongoing oversight and guidance to help our clients make informed decisions and achieve long-term success.

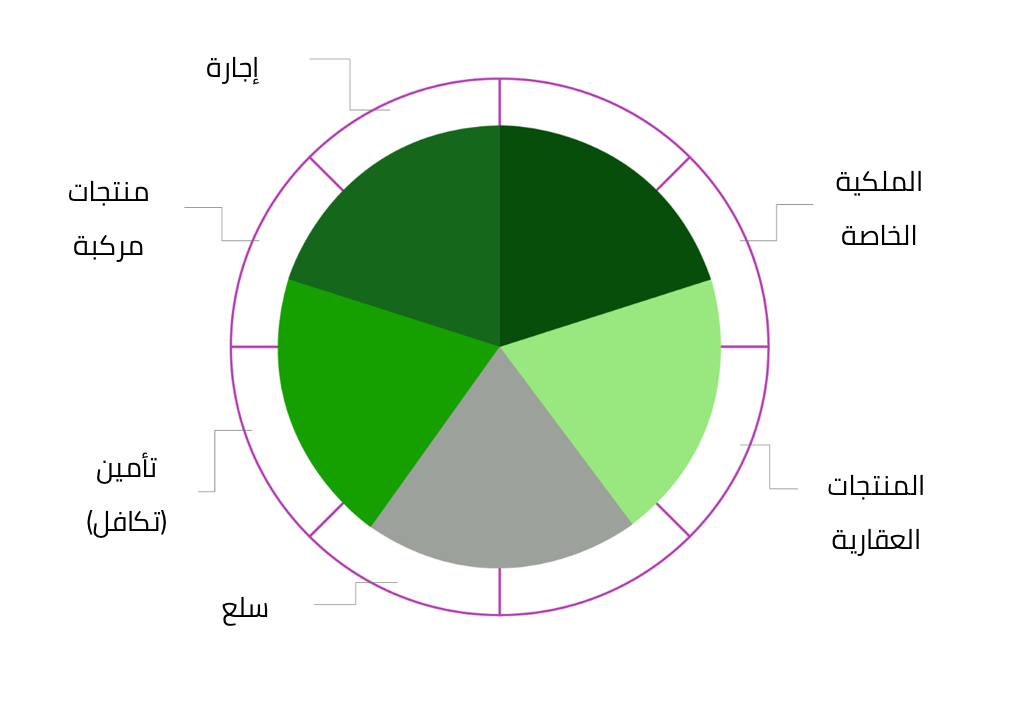

We provide our clients with the following wealth management products:

- Core Investment Products

- Structured Products

- Investment Research

- Discretionary Portfolio Management

- Takaful Insurance

Private Family Office

Some families need a wider range of services than what typical wealth managers provide. Their financial planning may require a multigenerational perspective that encompasses advanced estate planning, philanthropy, business planning, lifestyle services, and family development.

By taking on the role of family CFO, we can build a unique model around our clients’ families unique needs. We can coordinate their investment management, advanced planning strategies, and comprehensive administrative support to solve complex problems, ensure meticulous implementation, and free up our clients’ time to live their ideal lives.

Our Family Office Vision

Privately held professional entity established to manage the investments, business affairs and philanthropic interests of a high net worth family.

- Implement a strategy

- Effectively diversify, manage and enhance wealth

- Strike a balance between business and family interests

- Assist with family communication through a charter help to unite a family

- Transfer wealth

- Co-ordinate management activity

- Increase financial leverage

- Mitigate against conflicts of interest and

- Enjoy a chosen life style

Our Family Office Services

At the heart of any family office is investment management and financial oversight, but as your family office we can provide a number of different services

Investment Management Services

Typically, this will be the main reason for setting up a family office, as it is central to ensuring wealth preservation. These services will include:

- Evaluation of the overall financial situation

- Budget services, including wealth reviews, analysis of short- and medium-term liquidity requirements and long-term objectives

- Determining the investment objectives and philosophy of the family

- Determining risk profiles and investment horizons

- Recommendation and monitoring of a suitable asset allocation plan

- Recommendation of suitable investments

- Providing due diligence on investments and external managers

- Discretionary asset management

Philanthropic Management / Islamic WAQF

An increasingly important part of the role of a family office is managing its philanthropic efforts. This will include the establishment and management of a foundation, and advice on donating to charitable causes. These services would typically involve:

- Philanthropic planning

- Guidance in planning a donation strategy

- Assistance in formation of foundations and charitable trusts

- Organizing charitable activities and related due diligence

Business and Financial advisory

Beyond the asset management advisory as your family office we will also assist in providing advisory services on financing and business promotion. These will include:

- Debt review and management

- Bridge financing

- Structured financing

- Private equity

- Mergers and acquisitions

- Succession planning

Estate and Wealth transfer

As your family office, we will be involved in business succession and legacy planning along with your legal team, enabling the transfer of wealth to the next generation. These services will include:

- Wealth protection solutions and planning related to of all types of assets and income sources

- Asset protection strategies

- Guidance on family governance

- Guidance regarding wealth transfer to succeeding generations

- Assistance with the adoption of a family charter or constitution

How can we serve you?

Do you have ideas? Share your opinions and suggestions We will be happy to do so!